You are now leaving Centuria Australia

and entering Centuria New Zealand.

How we select our investment managers and investment options

Investment choice

Centuria LifeGoals offers a broad investment menu covering the following asset classes: cash, fixed interest, property, infrastructure, international and Australian shares, small companies, diversified funds and total return targeted funds.

Centuria LifeGoals provide access to a wide range of high quality active investment managers selected by Centuria Life and low-cost specialised index investments.

The active investment managers have been carefully selected to offer a high level of expertise in their chosen fields. They offer different investment styles to satisfy a wide variety of investor goals.

Active investment managers conduct research and choose to be underweight or overweight different stocks and sectors. Their objective is to outperform a relevant index. These investment managers will typically charge a high fee and may have a performance fee. We provide access to a range of active investment managers that vary in style and objectives, who have been selected based on a range of measures.

As part of the selection process, our team meets with and interviews prospective investment managers. Our research is focused on providing access through the Investment Options to high-quality investment managers in each asset class.

We will conduct reviews of the investment menu to monitor whether each Investment Option and investment manager is operating in a manner consistent with the description in this PDS. At times, investment managers with a certain style or bias may underperform and this will be monitored by Centuria Life and investment managers may be replaced from time to time.

A low-cost index option is also available to investors for each major asset class. Index managers aim to replicate the performance of the relevant index they track and will typically have lower management fees as they do not conduct the in-depth research required for active investment management. For example, an Australian large-cap share index manager seeks to mirror the performance of the ASX All Ordinaries Index by replicating its holdings.

Centuria LifeGoals offer a range of index funds and active managers and therefore our menu options are able to help fulfil the investment strategies of a diverse group of investors. Investors can select the investment managers and asset classes that best meet their financial goals.

Investment process

We believe that investment choice is important for investors. Selecting the right investment manager is an important investment decision. Centuria Life undertakes research and due diligence enquiries to select and review the investment managers and funds to place on the investment menu.

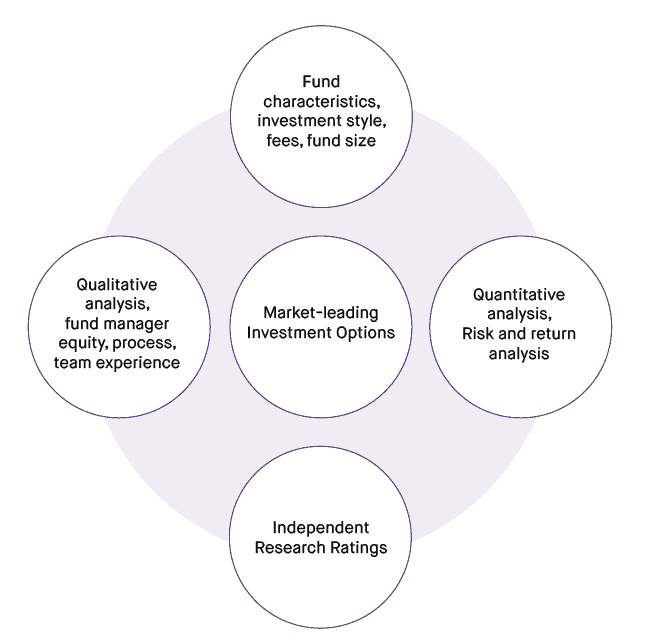

The diagram opposite summarises the key considerations Centuria Life uses to select investment managers.

Centuria Life believes that a robust investment process is important to making good long-term decisions. In reviewing investment managers, Centuria Life considers the following:

Fund characteristics

- Investment style such as value, growth or quantitative

- Competitive fee structure

- Funds under management relative to sector size that may influence ability to execute trading strategies.

Research house ratings

- Research from a number of independent research agencies are analysed and only those funds with superior ratings will be considered.

Quantitative analysis

- Superior risk-adjusted returns to peers

- Absolute return comparisons that include trailing total returns, calendar period performance and rolling-period results versus appropriate style-based benchmarks and/or peer groups

- Various risk or return volatility measures such as standard deviation, beta and/or maximum drawdown analysis

- Regression analysis

- Risk-adjusted metrics, such as Alpha, Sharpe Ratio, Information Ratio, and Sortino Ratio.

Qualitative analysis

- Centuria Life will meet and interview prospective investment managers to make well-informed investment decisions

- An analysis of investment professional talent is important in the evaluation of investment managers

- We generally look for established investment teams that have worked together for a number of years

- Low staff turnover is generally desirable.

Centuria Life also takes advice from external experts and investment consultants and its actuary (appointed pursuant to provisions of the Life Insurance Act) on a range of investment management matters.

In implementing the investment strategies of Centuria LifeGoals we may from time to time:

- Add, remove or replace investment managers. The structure of Centuria LifeGoals means investment managers who do not meet the investment criteria can be replaced without tax implications to the Investor. This is an advantage of Centuria LifeGoals over a managed fund or share investment where the change of underlying investment managers may have CGT implications for investors

- Write to Investors providing at least 30 days notice of the intention to replace an investment manager, outlining why the change is being made and will provide information on the replacement investment manager

- Close or cease to accept new contributions into one or more of our investment options.

How we select investments for Centuria multi-manager investment options

Our Investment Committee is responsible for approving and overseeing the implementation of the investment strategy for each of the investment poptions. The Investment Committee is responsible for making decisions on matters such as asset allocation, investment manager selection and portfolio construction. The Investment Committee also takes advice from external experts and investment consultants and our appointed actuary, on a range of investment management matters.

Our Investment Committee meets regularly to review the fund’s investment strategies. process, which includes regular meetings with underlying fund managers, consideration of their investment style, investment process, the expertise of their investment team, past performance and other factors. We also review our investment managers’ performance on an ongoing basis to ensure they operate in accordance with our specified investment criteria.

Each of our investment managers (including our related companies) are entitled to receive fees for their services at commercial rates as agreed from time to time by us. These fees are paid from Centuria’s management fee and are not an additional cost to you. The underlying assets of the Centuria multi-manager investment options may be managed using a range of investment managers and investment styles. We may appoint an investment manager pursuant to an individual investment mandate or invest via a managed fund.

Authorised investments

The assets of each investment option must be invested in accordance with the Life Insurance Act (including any prudential standards made under the Life Insurance Act) and the Fund Rules.

The Fund Rules specify a range of authorised investments into which the assets of an investment option may be invested.

Use of derivatives

We and/or the underlying investment managers may use derivatives, such as futures and options, for hedging purposes and/or to implement an investment strategy. However, we and/or the underlying investment managers will not use derivatives for gearing purposes or speculative activities. If derivatives are used, it is on the basis that the relevant investment option can always meet its commitments without having to borrow.

Labour standards and environmental, social and ethical considerations

In setting or implementing investment strategies for Centuria LifeGoals, and when selecting or retaining investment managers, we do not give additional weight to labour standards or environmental, social or ethical considerations. Importantly though, Centuria Life supports sustainable, socially responsible enterprises that also offer attractive prospective returns and Centuria Life may classify certain investment option as a responsible investing investment option.

In order for a fund to be included as a responsible investing investment option, our screening process has been adapted in order to seek investment options that have strong Environmental, social and governance practices that contribute to the achievement of the United Nations Sustainable Development Goals and are signatories to the Principles of Responsible Investing (PRI).

For all other investment options which are not classified as a responsible investing investment option, Centuria Life does not take into account labour standards or environmental, social or ethical considerations for the purpose of selecting, retaining or realising investments of the underlying fund.

Invest today

You are one step closer to securing your future. Download the Centuria LifeGoals PDS to start investing today.

You can apply online for a simple and easy application process, or contact us for any investment, product or administrative enquiries.